Last updated 29 May 2024

Give your family financial protection

Dependants' Protection Scheme (DPS)

Dependants’ Protection Scheme (DPS) is an affordable term life insurance that covers insured CPF members in the event of death, terminal illness, or total permanent disability.

DPS provides basic financial protection for your family. You are highly encouraged to apply for or continue your DPS coverage especially if you belong to the 'sandwich generation' with young children and elderly parents to care for. DPS is currently solely administered by Great Eastern Life directly.

Up to 60 years old

Maximum sum assured

$70,000Above 60 years old and up to 65 years old

Maximum sum assured

$55,000DPS coverage is automatically extended to all Singaporeans and Permanent Residents (PRs) between 21 and 65 years old upon their first CPF working contribution. You may check the status of your DPS coverage through your yearly CPF Statement of Account, or online through the CPF website by logging in via your Singpass.

If you are 16 years old and above and have not been offered automatic coverage, you can apply to join DPS with Great Eastern Life directly.

If you are working and have dependants relying on your income, DPS provides affordable basic protection for your family.

However, you may not require DPS if:

- Your dependants have already grown up, or are financially independent, or both.

- You have built up enough savings which could be passed on to your dependants directly in times of need.

- You have your own private term or life insurance, which provides enough protection for your dependants.

DPS premiums will be automatically deducted from your CPF savings on your annual policy renewal.

Alternatively, you can pay your DPS premiums directly in cash (via GIRO) to the DPS insurer, Great Eastern Life.

Start your child's financial journey early

Child Development Account (CDA)

The Child Development Account (CDA) is part of the Baby Bonus Scheme designed to help you defray child-raising costs, such as educational and healthcare expenses at approved institutions.

The Baby Bonus scheme for Singapore Citizen children whose date of birth is on or after 18 Feb 2025 is as follows:

1st Child

Cash gift

$11,000CDA First Step Grant

$5,000Maximum Government co-matching

$4,0002nd Child

Cash gift

$11,000CDA First Step Grant

$5,000Maximum Government co-matching

$7,0003rd and 4th child

Enhanced Cash gift

$13,000CDA First Step Grant

$10,000*Maximum Government co-matching

$9,0005th and subsequent child

Enhanced Cash gift

$13,000CDA First Step Grant

$10,000*Maximum Government co-matching

$15,000CDA can be used for your child’s medical and education needs, for example paying for childcare center or outpatient fees, at Approved Institutions.

- After signing your child up for the CDA, any unused funds from your CDA can be transferred to the Post Secondary Edusave Account (PSEA), an account that is set up for every Singaporean child when they turn 13.

- Note: The PSEA balance earns an interest of 2.5% per annum.

- When your child reaches the age of 30, any remaining funds your child have will be transferred to your CPF Ordinary Account (OA) which gives a higher interest rate of up to 3.5% and also can be used for his or her future needs, for example housing, education and healthcare.

- Check your eligibility to find out if you can open a CDA for your child.

- If your child was born in Singapore and is a Singapore citizen, your Baby Bonus application will be part of your child’s birth registration on LifeSG.

- If your child has already registered their birth, is a new citizen, or is adopted, apply directly through the Apply for Baby Bonus service.

- During the application, you'll need to select the bank you want to open the CDA with. You can choose either DBS/POSB, UOB or OCBC.

- Go to your selected bank's website to open your CDA. It'll be opened with initial balance of $3,000.

- You'll receive a notification once this has been done. A NETS card will be issued under your child’s name and sent to your registered address. You can then use it to pay for eligible products and services at CDA approved institutions.

How you can help your loved ones grow their retirement savings by topping up your CPF accounts

Top up for higher payouts under the Retirement Sum Topping-Up Scheme (RSTU)

The Retirement Sum Topping-Up Scheme (RSTU) helps you grow your retirement savings and that of your loved ones so that they can enjoy higher monthly payouts when they retire.

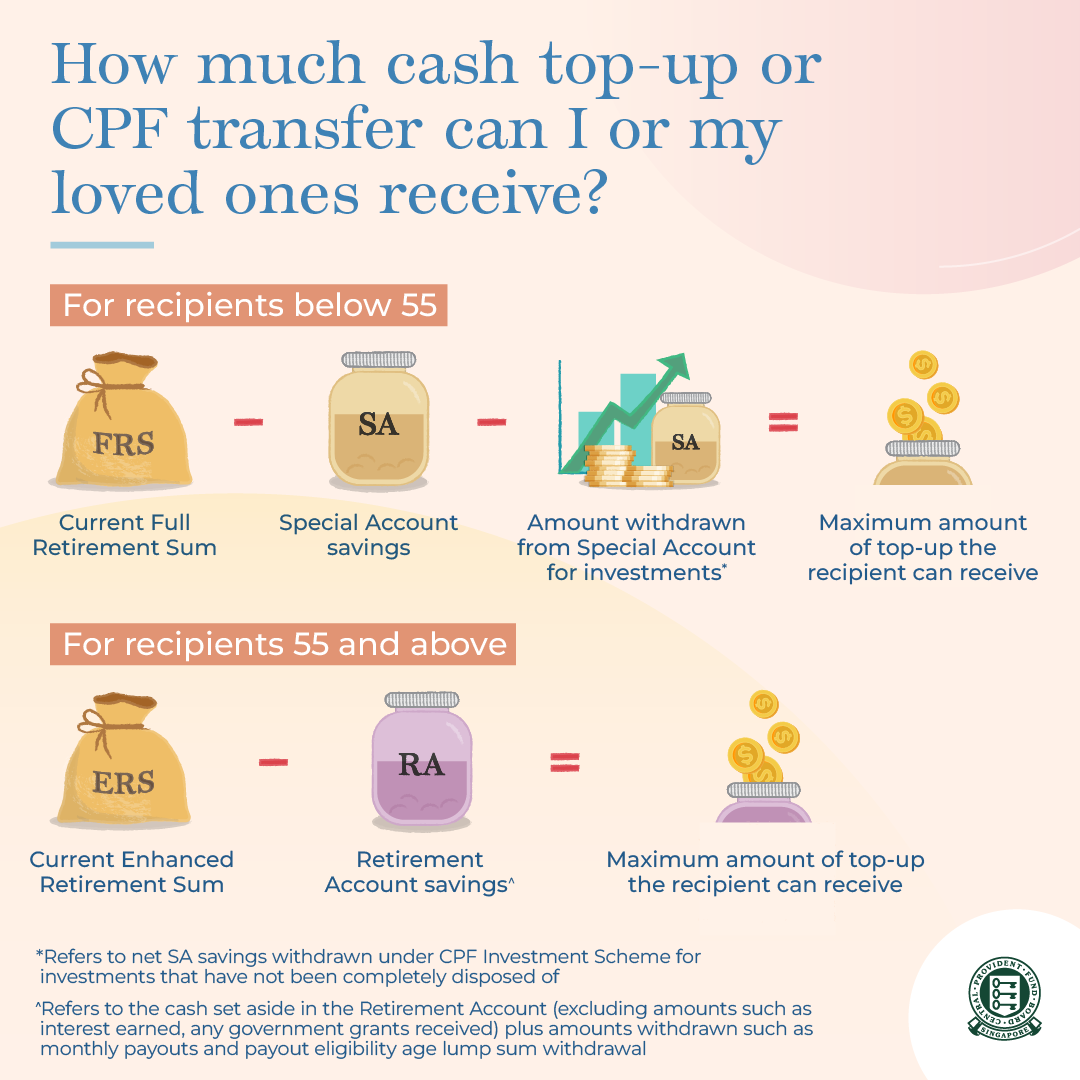

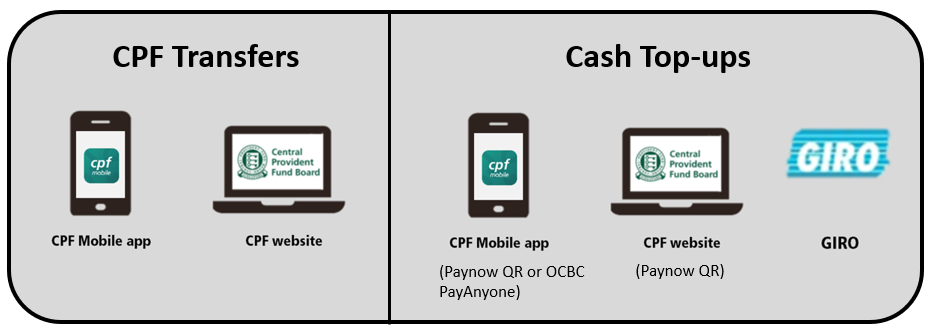

You can top up to your loved ones’ CPF Special Account, if they're below 55 years old, or Retirement Account, if they're 55 years old and above. Top-ups can be made in cash, CPF transfers or both.

Use the Retirement Payout Planner to explore ways to make the most of your CPF to achieve your goal.

- Your top ups to your loved ones’ CPF Special Account, if they're below 55 years old, or Retirement Account, if they're 55 years old and above, can earn attractive interest of up to 5% or 6% per annum*.

- Your loved ones enjoy higher monthly payouts.

- You can enjoy tax relief* equivalent to the amount of cash top-ups made, up to $8,000 per calendar year when you make cash top-ups for your loved ones, such as parents, grandparents, spouse and siblings. If you make a cash top-up for yourself, you can enjoy additional tax relief* of up to $8,000 per calendar year too.

- Under the Matched Retirement Savings Scheme (MRSS), the Government will match every dollar of cash top-ups to eligible* seniors who have yet to reach the Basic Retirement Sum (BRS), up to $600 per year.

*Terms and conditions apply.

Your loved ones can log in the CPF website with their Singpass to view how much they can receive.

Learn how you can help your loved ones grow their retirement savings by topping up your CPF accounts.

MediSave Top-Ups for Your Seniors at Home

MediSave is a CPF member’s personal healthcare savings account. Working members save between 8% to 10.5%, depending on age, of their monthly salary in their MediSave Account. This helps members set aside part of their income for healthcare expenses, especially those incurred during retirement years.

- Your parents would have their own MediSave if they have ever made CPF contributions, or someone in the family has made voluntary top-ups for them before.

- Your parents may have also received further MediSave top-ups under the Pioneer Generation or Merdeka Generation Packages.

- Read more about MediSave to find out about its benefits, uses, and other important information.

MediSave can be used to pay for selected outpatient treatments, hospitalisation and day surgery expenses, subject to the respective MediSave withdrawal limits. MediShield Life, ElderShield and CareShield Life premiums are also fully payable from MediSave.

MediSave can be used for yourself or your family members, including your parents, grandparents, spouse, children, or siblings.

- You can earn up to 6% interest per annum on your MA savings.

- You can save up faster for your healthcare needs and also use your MA to pay for your healthcare insurance schemes' premiums.

- You can enjoy tax relief* by making a cash top-up to your own or your loved one's MA.

*Terms and conditions apply.

You can make a top up via the Top up MediSave Account form using PayNow QR.

You will be prompted to key in your recipient's NRIC or CPF account number if you are making a top-up to your loved ones.